EU Financial Services – What does the FSB think of AI in financial services?

November 17 , 2024| Website | Twitter | Linkedin | Substack

This week we will deep-dive in the use of AI in finance, our three main topics will be:

- The recent developments in the use of AI in finance

- The specific use cases in the industry and regulators

- The implication for the financial system

As you will remember, we briefly touched upon the AI in Finance some weeks ago, also on Big Techs, take a look if you missed it! More recently, the Financial Stability Board (FSB) published a report and as we promised we will have a look at it and as always, we are very happy to have you again.

As context, the report takes stock of the recent use of AI in finance and its specific use cases in the industry. The first part superficially discusses the use of AI. The FSB explains that they lack data to assess how significant the uptake of the technology is in the financial sector. It underlines that global regulators are left behind regarding AI, they lack on speediness, understanding the data, and lack skilled people to interpret it. This gap may keep on growing considering how fast the tech grows…

Financial authorities face two key challenges for effective vulnerabilities surveillance: the speed of AI change and the lack of data on AI usage in the financial sector. - FSB

Recent developments in the use of AI in finance

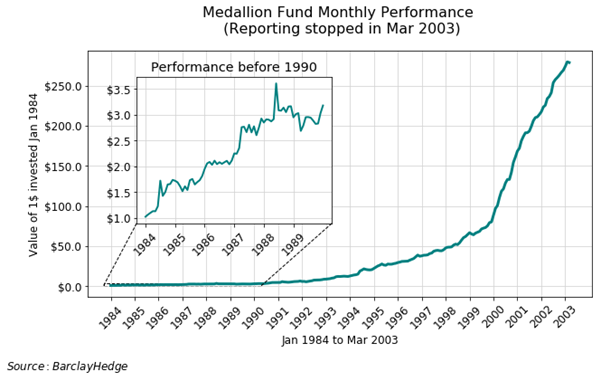

- The financial sector has been using AI for a long time. You may have for instance heard about the Medallion fund by Renaissance Technologies. The company founded in 1978 integrated the use of machine learning and quantitative models to detect patterns across markets. Medallion’s managers used to integrates these quantitatives results in their ‘Medallion fund’ that became one of the most successful hedge funds, averaging a 71.8% annual return from 1994 until 2014 (before fees).

- The integration of AI and its use accelerated across the sector with the recent hard- and software developments. Several new techs developed helping the AI to spread progressively across the financial sector: deep learning, big data, computational power and GenAI.

- Deep learning models are now able to manage more complex data structure and make more sense out of it, thanks to the development of graphic processing units (GPU). The broader integration of Natural Language Processing (NLP) democratized the use of computers even further by using speech, text and voice rather than only typing or programming.

- The International Monetary Fund (IMF) estimates that by 2027 investments in software, hardware, and services for AI systems in the financial services sector could reach $400 billion, a 41% increase compared to 2023 where it was $166 billion 'only'…

- Interestingly, the FSB considers that AI will have consumed all the real-data available (created from reality and considered as high-quality) will be reached between 2026 to 2032.

We forecast the growing demand for training data based on current trends and estimate the total stock of public human text data. Our findings indicate that if current LLM development trends continue, models will be trained on datasets roughly equal in size to the available stock of public human text data between 2026 and 2032, or slightly earlier if models are overtrained […] - FSB

- From this point, AI will still have to be fed with data to develop and grow, they could turn towards the consumption of synthetic data (computer generated data). This could raise challenges related to intellectual property, privacy and the quality of the data produced. The usage made by financial institutions is clear but the future of financial services seems quite science-fiction like reading the FSB report.