NBFI - What is cooking in the EU?

November 11, 2024| Website | Twitter | Linkedin | Substack

Welcome to Brussels Regulation, your weekly newsletter digging into politics, regulation and finance.

This week we will discuss the recent developments about Non-Banking Financial Intermediation (NBFI), focusing on:

- What are the international discussions?

- What will the European Commission do in the upcoming mandate?

- Are these risks justified?

What are the international discussions focusing on?

- Since 2011, the Financial Stability Board (FSB) has been focusing increasingly on the NBFI.

- NBFI encompasses a very broad range of financial institutions, from insurers, pension funds, asset managers to family office, venture capital and private equity.

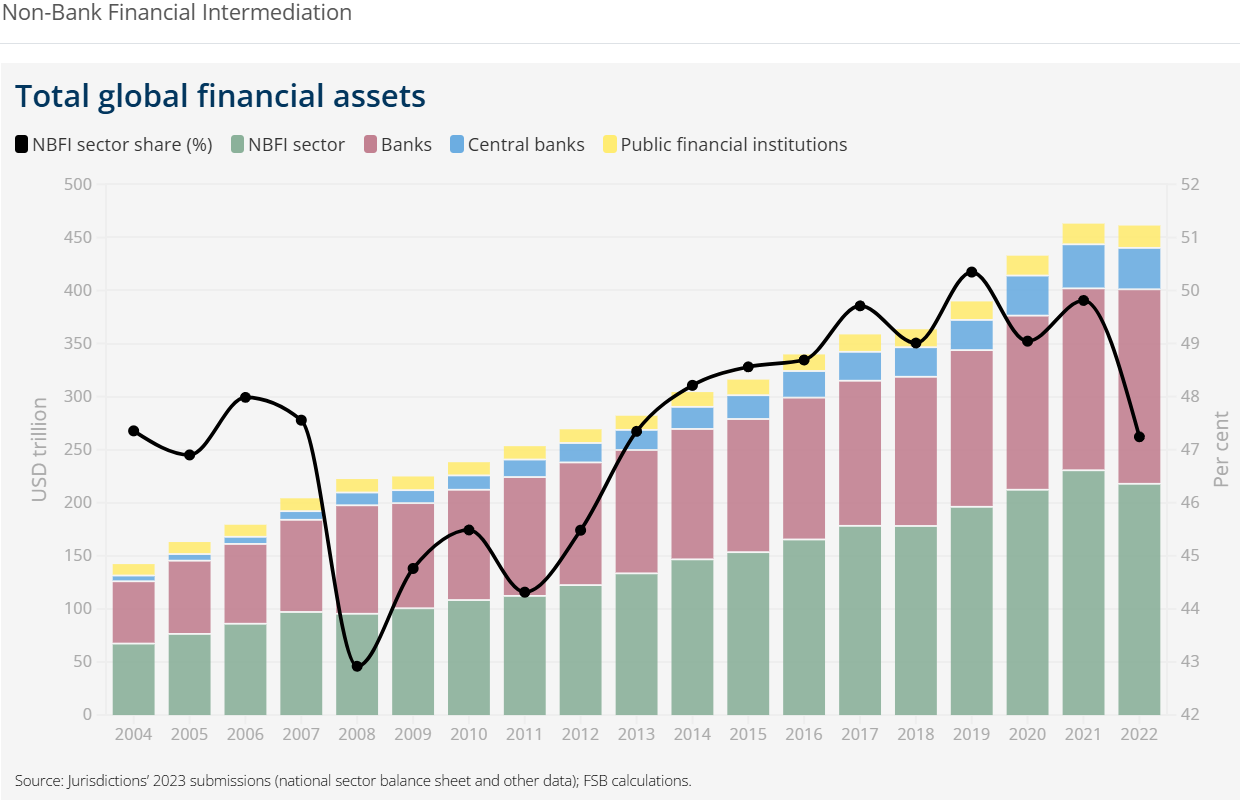

- They represent a bit less than 47% of global financial market assets. In the EU, the European Commission estimates it to roughly to 41% of the EU financial sector’s assets, amounting to €42.9 trillion assets in 2023.

- The preoccupation of global regulators (IOSCO also looks into it) comes from its growth over the last 20 years, with the banking system depending more and more on NBFI's services.

- To keep in mind, many of the larger asset managers (making a large part of NBFI's) are subsidiaries or closely linked to banks and insurers managing money on their behalf. Logically, their assets tend to grow proportionally to banks' assets, further increasing their share in the financial sector.

- Additionnally, the diversity of NBFI's activities and business models is so vast, it seems easy to find potential risks stemming from them.

- As you might expect, the FSB has developed several work streams to address these risks, accompanied by policy recommendations intended to trickle down to national jurisdictions.